As we approach the dawn of 2024, the U.S. economic terrain appears relatively sturdy compared to its state a year ago. Inflationary pressures have eased, labor markets stand resilient, and the Federal Reserve cautiously contemplates the prospect of reducing interest rates in the upcoming year.

Economists, including members of the Federal Open Market Committee (FOMC), project a gentle descent for the U.S. economy in 2024, foreseeing a deceleration in GDP growth without the ominous shadow of a recession. However, the precarious balance lies in the hands of the Federal Reserve, where a single misjudgment could potentially plunge the economy into a recessionary abyss, making the next few months a pivotal juncture for the central bank.

Decoding Recession Risk Factors in 2024

Various factors can trigger or contribute to a recession, but two predominant risks loom large on the economic horizon in 2024.

1. Inflation Rollercoaster

For the informed investor, the primary economic risk factor entering 2024 is undoubtedly inflation. After surging to a 40-year high of 9.1% in June 2022, the year-over-year consumer price index inflation has tapered to a more manageable 3.1% as of November 2023.

2. Interest Rate Tightrope

The second risk factor gripping 2024 is the elevation of interest rates. The Federal Reserve, in its robust pursuit of curbing inflation, has elevated interest rates to 22-year highs. This strategy has made considerable headway in steering inflation towards its long-term goal of 2%. However, higher interest rates amplify the cost of borrowing, dissuading companies from debt-driven expansion and curbing consumer spending.

The Federal Reserve, having executed 11 interest rate hikes since March 2022, faces a delicate balancing act. Despite predictions of a shift from rate hikes to cuts by March 2024, the persistence of sticky inflation, especially in segments like children’s clothing, auto insurance, and medical products, may impede the Fed’s progress.

Recession Speculation: To Be or Not To Be in 2024

As of now, inflation and soaring rates have not yet inflicted substantial damage on the U.S. economy. Job additions of 199,000 in November and an historically low unemployment rate of 3.7% indicate resilience. However, vigilant monitoring of the labor market is crucial, considering the typical lag in the impact of tight monetary policy on economic growth.

While U.S. GDP surged by 5.2% in Q3 2023, Federal Reserve projections for 2024 hint at a significant slowdown to a mere 1.4% for the entire year.

Signals and Warnings: Indicators of Economic Health

Several indicators raise caution flags for investors contemplating the future economic landscape:

- Yield Curve Inversion: The 10-year and two-year U.S. Treasury yield curve has been inverted since mid-2022, historically signaling an impending recession.

- Credit Card Debt Records: U.S. credit card debt surpassing $1 trillion raises concerns, especially as delinquencies on mortgages, auto loans, and credit cards show an upward trend.

- Recession Probability Model: As of December 4, the New York Fed’s recession probability model suggests a 51.8% chance of a U.S. recession in the next 12 months.

Expert Opinions on the Economic Horizon

Despite the prevailing risks, experts express varying viewpoints on the likelihood of a U.S. recession in 2024.

Bill Adams, Chief Economist for Comerica Bank, emphasizes the resilience of U.S. consumer spending trends, falling long-term interest rates, and declining gasoline prices as factors lowering the recession risk.

Chris Zaccarelli, Chief Investment Officer for Independent Advisor Alliance, acknowledges real risks but underscores the resilience of the labor market and the consumer as crucial elements often overlooked by pessimistic forecasts.

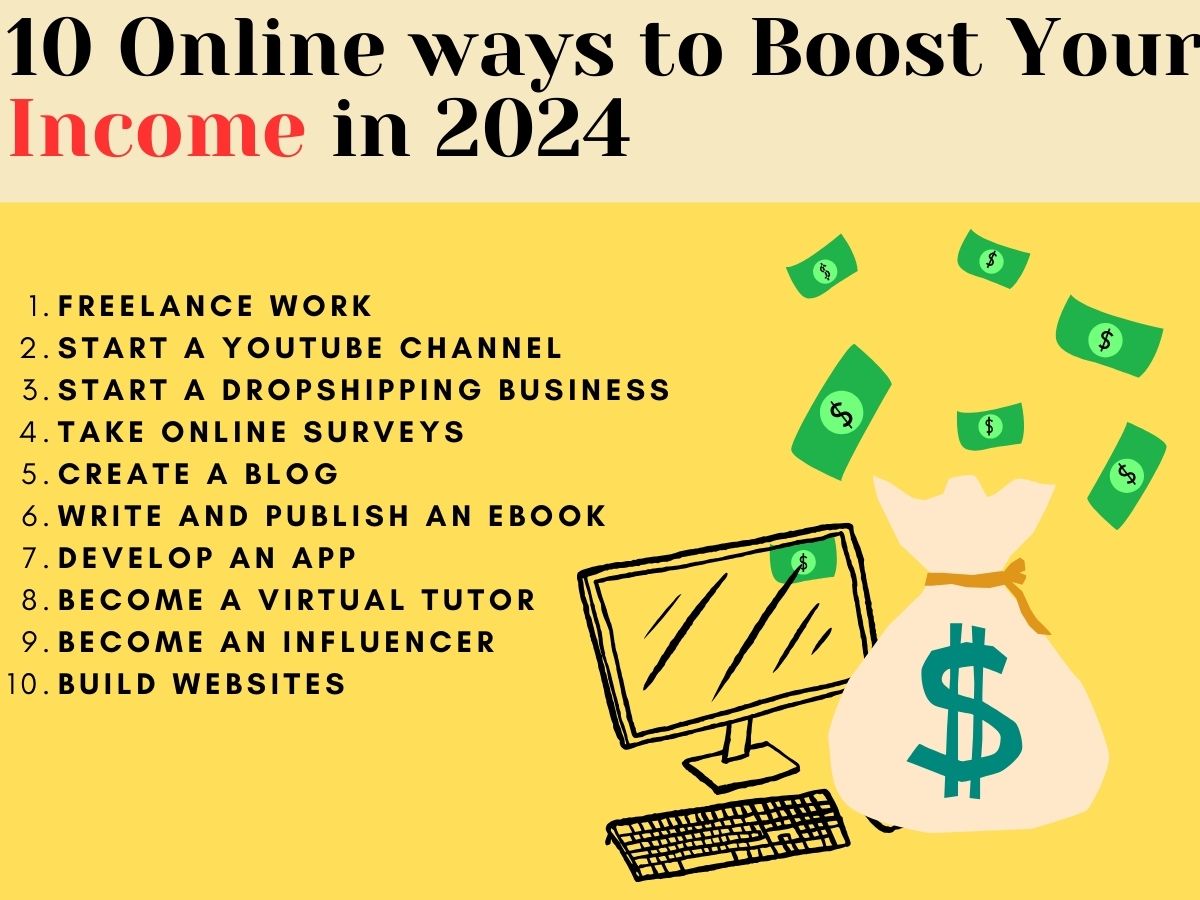

Strategic Approaches for Investors

For investors preparing for potential economic headwinds in 2024, adopting strategic approaches becomes imperative.

- Cash is King: Consider reducing exposure to volatile stocks and increasing cash holdings. While not the most exhilarating choice, cash provides a buffer against market risks and offers financial flexibility.

- Defensive Stocks: Defensive stocks in sectors like utilities, healthcare, and consumer staples, known for their insulation from economic cycles, can outperform during recessions.

- Individual Stock Picks: Certain individual stocks, historically resilient during recessions, include Walmart Inc. (WMT), Abbott Laboratories (ABT), and Synopsys Inc. (SNPS).

- Quality Stocks: Focus on high-quality stocks with robust balance sheets. Buffered exchange-traded funds (ETFs) can manage risk effectively during market downturns.

- Investment Recommendations: Explore investment opportunities across asset classes while remaining mindful of economic risks. Consider ETFs like iShares MSCI USA Quality Factor (QUAL), iShares Large Cap Moderate Buffer (IVVM), and iShares Russell Top 200 Growth Index Fund (IWY) for potential resilience.

In the intricate dance of economic variables, investors must tread cautiously, leveraging knowledge and strategic positioning to navigate potential challenges and seize opportunities in the unfolding narrative of 2024.